So, your balance sheet is flexing a healthy “Accounts Receivable” balance. Nice. That means you’re rolling in it… or you will be, once you actually get paid.

Most businesses, at some point, play the role of a lender. When you offer goods or services to customers on credit, you’re letting them walk away with the goods with a promise to pay later. In the world of bookkeeping, this promise is recorded as Accounts Receivable. It’s the cash your business is owed.

Because this money is legally yours, accounts receivable is considered an asset, not revenue. This is a crucial distinction. It doesn’t show up on your income statement but takes its rightful place on the balance sheet and trial balance.

So, when it comes to the big question – is accounts receivable a debit or credit entry? It’s a debit. To understand why, we need to peek behind the curtain at the magic of double-entry accounting.

In the grand theater of double-entry accounting, every transaction hits at least two accounts to keep the universe in balance. The golden rule is the fundamental accounting equation: Assets = Liabilities + Equity. When you make a sale on credit, you debit Accounts Receivable (increasing your assets) and credit Revenue (increasing your equity). The books stay perfectly balanced, reflecting that you have a claim to that cash.

But here’s the catch: while Accounts Receivable represents future income, it isn’t cash in the bank. Many businesses face the headache of collecting these receivables, which can throw a wrench in their liquidity. Managing your accounts receivable effectively is the only way to make sure those impressive sales numbers actually turn into real, spendable revenue.

What the Hell Are Accounts Receivable?

Accounts receivable (AR) is the money people owe you. Simple as that.

It’s the official IOU in your books for goods you’ve delivered or services you’ve rendered that customers haven’t paid for yet. Think of it as the sum of all your outstanding invoices – a pile of promises from clients who got what they wanted on credit.

How does it work? You provide a service, the customer says “put it on my tab,” and you give them a due date. These payment terms are usually short, ranging from a few days to a year. You record this future cash in a special place called the accounts receivable account, which lives in your asset book.

On the flip side, your customer records the same transaction in their books as Accounts Payables – a liability representing the money they owe you.

Accounts receivable, sometimes called ‘trade receivable,’ is your legal right to collect cash because you’ve already held up your end of the bargain. A classic example is the electric company. They supply you with power all month, you use it, and then they send a bill. That unpaid bill is their accounts receivable. They’re waiting for you to pay up.

Many businesses run on this model, letting frequent customers rack up a tab and pay it off with a single periodic invoice. It’s convenient for them and, hopefully, profitable for you.

How to Account for Accounts Receivable

So, is accounts receivable an asset or liability? It’s 100% an asset, and on the balance sheet, it gets a debit to increase its balance.

Specifically, AR is considered a current asset. Why? Because you expect to convert these IOUs into actual cash within a year. Companies confidently list it on their balance sheets as a sign of pending income.

If, for some reason, a payment is due in more than a year, it gets reclassified as a long-term asset, maybe as a note receivable, but it stays an asset.

Now for the fun part. While customers are legally obligated to pay, some… just don’t. This is where the romance of running a business meets the harsh reality of human nature.

When a customer ghosts you on their bill, that non-payment is recorded as bad debt. This makes accounts receivable a bit of a gamble. It’s an “investment,” which is a fancy term for betting on strangers to pay you back.

And this isn’t a small problem. On average, companies write off a staggering 1.5% of their receivables as bad debt. For a business with $50 million in annual revenue, that’s a $750,000 gut punch to the bottom line.

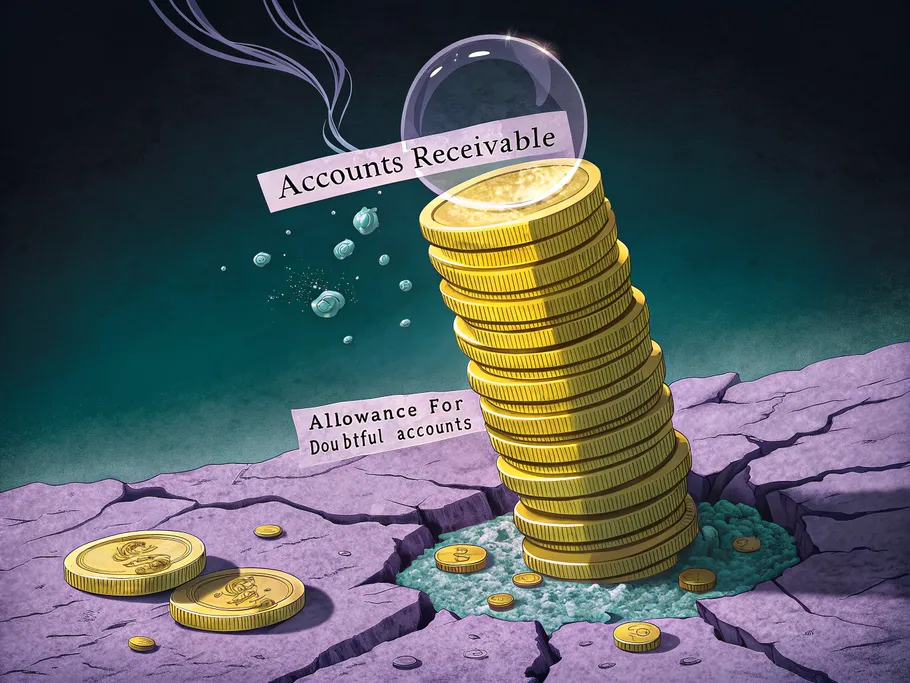

To manage this risk, accountants use a clever tool called the allowance for doubtful accounts. It’s a contra-asset account that acts as a rainy-day fund, proactively estimating and setting aside a portion of receivables that you suspect will never be collected. It’s like admitting that expecting everyone to be reliable is, well, a doubtful strategy.

Accounts Receivable Journal Entries: A Practical Guide

Can’t nail the basic and common accounts receivable journal entries?

Then you’re not running a business; you’re just playing an expensive game of hide-and-seek with your money.

Let’s walk through the play-by-play of how money flows in and, sometimes, doesn’t.

Making the Sale on Credit

Let’s say Company ABC sells $30,000 worth of pharmaceutical products to Mr. Peter on September 1st, with payment due by October 1st.

Here’s the initial journal entry:

| Date | Account | Debit | Credit |

|---|---|---|---|

| Sep 1, 2020 | Accounts Receivable | $30,000 | |

| Revenue | $30,000 | ||

| To record sales on credit |

At this point, the Accounts Receivable account is debited because the cash hasn’t arrived yet. You’ve made the sale, so Revenue gets credited, but the actual money is still just a promise.

Getting Paid in Full

Fast forward to September 20th. Mr. Peter, a model customer in this scenario, pays the full $30,000.

The journal entry to record the payment looks like this:

| Date | Account | Debit | Credit |

|---|---|---|---|

| Sep 20, 2020 | Cash | $30,000 | |

| Accounts Receivable | $30,000 | ||

| To record cash received |

Company ABC’s Cash account gets a $30,000 debit (an increase), and the Accounts Receivable account is credited for the same amount, bringing its balance for this transaction to zero. The promise has been fulfilled.

Getting a Partial Payment

Now, let’s imagine Mr. Peter could only scrape together $20,000 by September 20th.

Here’s how you’d record that partial payment:

| Date | Account | Debit | Credit |

|---|---|---|---|

| Sep 20, 2020 | Cash | $20,000 | |

| Accounts Receivable | $20,000 | ||

| To record partial payment received |

Your Cash account increases by $20,000, and the Accounts Receivable account is credited for the same amount. This leaves a $10,000 debit balance in AR, reminding you that Mr. Peter still owes you money.

Accounting for Bad Debt

Sometimes, a customer decides paying you is more of a suggestion than an obligation. This is where we encounter bad debt.

There are two main ways to handle this inconvenient truth.

The Direct Write-Off Method:

Let’s say Mr. Peter’s life goes sideways, and he can’t pay the $30,000 at all. With the direct write-off method, you accept the loss and record it directly as an expense.

| Date | Account | Debit | Credit |

|---|---|---|---|

| Oct 1, 2020 | Bad Debt Expense | $30,000 | |

| Accounts Receivable | $30,000 | ||

| To write off uncollectible account |

This amount hits your Profit and Loss Account directly, reducing your net profit. It’s a clean break, but it can make your financials look lumpy and reactive.

The Allowance Method:

If you’re dedicated to maintaining appearances and smoother financial statements, you use the allowance for doubtful accounts. This is a fancy way of budgeting for the fact that you’ll inevitably get screwed over.

You predict a certain amount of bad debt based on history and set up a contra-asset account to prepare for it:

| Date | Account | Debit | Credit |

|---|---|---|---|

| Jan 1, 2020 | Expenses | $50,000 | |

| Allowance for Doubtful Accounts | $50,000 | ||

| To create a bad debt allowance (provision) |

When you confirm Mr. Peter won’t be paying, the entry is:

| Date | Account | Debit | Credit |

|---|---|---|---|

| Oct 1, 2020 | Allowance for Doubtful Accounts | $30,000 | |

| Accounts Receivable | $30,000 | ||

| To write off uncollectible account |

Instead of hitting your expenses at the moment of default, you write off the receivable against the allowance you already created. This method provides a more accurate picture of your receivables’ value over time, acknowledging from the start that not all promises are kept.

The Bottom Line: Why Accounts Receivable is a Debit

Let’s cut through the jargon. Celebrating a growing Accounts Receivable balance is like celebrating the fine art of not getting paid yet. Sure, it looks good on paper, but it’s not cash in your pocket.

Here’s the simple truth: Accounts receivable is an asset, and that’s why it’s increased by a debit. In the beautifully balanced world of accounting:

- Assets and Expenses have natural debit balances. A debit makes them bigger.

- Liabilities, Equity, and Revenue have natural credit balances. A credit makes them bigger.

Since AR is the money customers owe you, it’s something your company owns – an asset. It’s future cash. Therefore, to increase your AR (when you make a sale on credit), you debit the account.

When the customer finally pays up, the magic happens:

- You debit your Cash account because your cash has increased.

- You credit your Accounts Receivable account because the customer’s debt to you has decreased.

This isn’t just academic. Managing this asset effectively is the difference between a healthy cash flow and a balance sheet full of empty promises.