Alright, let’s dive into the fascinating world of comparative advantage. No, it’s not just economic mumbo-jumbo reserved for stuffy boardrooms or economists in tweed jackets. It’s a concept that explains why France churns out world-class wine without breaking a sweat while Germany is the undisputed king of automobile manufacturing. Think about it: France’s lush vineyards and perfect climate make it a no-brainer for wine production. Meanwhile, Germany’s army of skilled engineers and precision-driven culture means they can build cars like nobody’s business. See the pattern? It’s all about each country playing to its strengths.

In this article, we’ll explore real-life examples of comparative advantage, show you how to calculate it (no complicated math degree required), and highlight its benefits in international trade. Buckle up; it’s going to be an enlightening ride!

What is comparative advantage?

So, what’s the big deal with comparative advantage? Think of it as the economic superpower that lets a country, company, or even you produce something more efficiently than others—not necessarily because you’re the best at it, but because you give up less to do it. It’s all about the trade-offs between input costs and benefits. Kind of like choosing between binge-watching your favorite show or finally hitting the gym—you pick the one where you lose less and gain more. Comparative advantage happens everywhere: between people, companies, and countries.

But for an entity to truly have a comparative advantage, three magic ingredients need to come together:

- Access to unique inputs: They’ve got to have different resources or inputs—think raw materials, specialized skills, or maybe a secret stash of unicorn dust.

- Products people actually want: They need to produce a good or service that folks are itching to buy. There’s no point in being the best at making pet rocks if no one wants one.

- Cost-effective production: It must cost them less to produce that good or service compared to others. After all, we’re all looking for a bargain, right?

Opportunity cost and comparative advantage

Now, here’s where things get spicy. Comparative advantage isn’t just about cranking out goods at a lower cost; it’s also about what you give up to make them—that’s called opportunity cost. Picture this: Every time you choose to produce one thing, you’re saying “nope” to producing something else. Those “something elses” are your opportunity costs.

So, for comparative advantage to be worthwhile, the opportunity cost must be low. Translation? You should produce what you’re good at, better than others, at a lower cost, and it should be the most profitable thing you could be doing with your resources. It’s like choosing to invest time in your promising startup instead of becoming a professional Netflix binger. One brings in the dough; the other… not so much.

If a country can produce something better and cheaper than another but has a high opportunity cost, then it’s not really a comparative advantage—it’s more like a comparative disadvantage. Ouch.

Example of comparative advantage and opportunity cost

Let’s bring this to life with a real-world scenario. Imagine China, a country known for both its cheap labor and its technological prowess. If China had to pick between focusing on cheap labor or doubling down on technology, which should it choose? Well, if technology brings in more revenue and boosts the GDP more than offering cheap labor, then it’s time to say “sayonara” to being the world’s factory floor. The opportunity cost of not focusing on tech would be too high. So, embracing technology becomes China’s comparative advantage.

Here’s another example closer to home. Suppose you’re absolutely fantastic at both cleaning your house and doing your laundry—better than any housekeeper you could hire. But your day job rakes in $10,000 a month, and hiring a housekeeper costs you $600 a month. Do you spend your precious time scrubbing floors, or do you outsource that and focus on your high-earning job? By choosing to hire a housekeeper, you give up saving $600 to earn $10,000. That’s a smart trade-off and a shining example of comparative advantage!

In essence, comparative advantage is all about specializing in what you’re best at while giving up the least profitable opportunities. It’s economics’ way of telling you to “do you” for maximum gain.

Benefits of comparative advantage

So, why should anyone care about comparative advantage? Great question! Here are some of the standout benefits for countries that embrace this concept:

- Increased economic growth: When a country specializes in an industry where it has a comparative advantage, it can export more products, leading to rapid economic growth. More exports mean more jobs and higher wages. Cha-ching!

- Reduced poverty: Specialization can create job opportunities, helping to reduce poverty levels. When industries thrive, they need more hands on deck.

- Enhanced stability: Countries with a comparative advantage in certain industries are less likely to face economic instability because there’s consistent demand for their products. It’s like having a financial safety net.

Disadvantages of comparative advantage

But hold your horses! Comparative advantage isn’t all sunshine and rainbows. There are some potential downsides:

- Resource depletion: Focusing too heavily on one industry can lead to the depletion of natural resources. Remember, overfishing doesn’t end well for anyone.

- Exploitation of labor: In the quest to maintain a comparative advantage through cheap labor, workers might face poor working conditions. Think long hours and low pay—not exactly a dream scenario.

- Economic vulnerability: Relying on a single sector can backfire if that industry takes a hit. For example, oil-dependent countries can face crises when global oil prices plummet—a phenomenon known as the Dutch disease.

- Geographical barriers: Sometimes, distance and transportation costs can erode the benefits of comparative advantage. Shipping goods halfway across the world isn’t always cost-effective.

- Incomplete picture: Comparative advantage doesn’t account for all factors that determine success in international trade, such as political stability or trade policies.

- Structural unemployment: Over-specialization might lead to workers lacking the skills to transition to other industries, causing unemployment when shifts occur.

Comparative advantage theory

The theory of comparative advantage suggests that countries can boost their wealth by focusing on producing goods where they have a lower opportunity cost and trading for everything else. It’s all about maximizing efficiency and making the most of what you’ve got.

David Ricardo’s comparative advantage theory

Enter David Ricardo, the British economist who formalized this concept in his book Principles of Political Economy and Taxation. Ricardo argued that even if one country is more efficient at producing all goods (an absolute advantage), it should still specialize in goods where it has the greatest efficiency and trade for others. It’s like telling Usain Bolt to focus on sprinting rather than trying to compete in marathon running, even if he’s better at both compared to most people.

Ricardo’s theory hinges on opportunity cost. If a country can produce one product with less sacrifice than another, it benefits by specializing in that product. It’s all about the best use of limited resources.

Factors of comparative advantage

Several factors contribute to a country’s comparative advantage:

- Technological superiority

- Natural resources

- Skilled labor

- Cheap labor

- Suitable weather and climate

These elements can give countries a leg up in producing certain goods or services more efficiently than others.

Technological superiority

Technology can be a game-changer. A country with advanced tech can produce high-quality goods at lower costs. Think of Japan’s dominance in electronics due to its cutting-edge technology and innovation. They’re not just making gadgets; they’re setting the global standard.

Comparative advantage and specialization

Specialization is the heart of comparative advantage. When a country focuses on producing goods where it has an efficiency edge, it can trade for other goods it needs. This not only maximizes production but also fosters international cooperation.

How does one achieve a comparative advantage?

Achieving comparative advantage isn’t about waving a magic wand; it’s about leveraging key factors of production:

Natural resources

Countries rich in natural resources can capitalize on them. The United States, with its vast oil reserves, has an advantage in energy production. Similarly, countries with fertile land can dominate agricultural markets.

Capital

Having ample capital allows countries or companies to invest in better equipment, research, and development, reducing production costs. More capital means more opportunities to innovate and stay ahead of the competition.

Labor

Whether it’s cheap labor or highly skilled workers, labor is crucial. China leverages its massive workforce to produce goods at lower costs, while Germany relies on highly skilled engineers to produce high-quality automobiles.

Technology

Investing in technology enhances productivity and product quality. It’s not just about making things faster but making them better. Technology can reduce errors, streamline processes, and open doors to new markets.

The level of education

An educated workforce can adapt to new technologies and innovate. Countries that invest in education often find themselves leading in industries that require specialized skills, like biotech or aerospace.

Skills in the workforce

Specialized skills can set a country apart. Japan’s workforce excels in precision engineering and electronics, giving it an edge in producing high-tech products.

Importance

Comparative advantage is a cornerstone of international trade. It allows countries to benefit from specialization and trade, leading to improved economic welfare. By focusing on what they do best, countries can increase efficiency, boost economic growth, and improve living standards.

Moreover, it can help countries navigate global market fluctuations. Those with strong comparative advantages are better positioned to withstand economic downturns, as there’s consistent demand for their specialized goods or services.

Comparative advantage examples

Let’s look at some real-world examples to see comparative advantage in action:

An example of comparative advantage between India and Japan

India and Japan have a symbiotic trade relationship. Japan exports high-tech machinery and electronics to India, leveraging its technological superiority. In return, India exports petroleum products, minerals, and agricultural goods to Japan, capitalizing on its abundant natural resources.

An example of the comparative advantage between China and the United States

The U.S. could produce items like clothing and electronics domestically, but often imports them from China, where production costs are lower due to cheap labor. Meanwhile, the U.S. focuses on exporting high-tech products like medical equipment and aircraft, where it holds a comparative advantage.

Comparative advantage example between Germany and Russia

Germany, with its skilled labor force, excels in producing automobiles and machinery. Russia, rich in natural resources, exports crude oil to Germany. This trade allows each country to benefit from the other’s strengths.

The comparative advantage of Vietnam

Vietnam has a comparative advantage in producing furniture, clothing, and textiles due to its low labor costs. It exports these goods to countries like the U.S., while importing agricultural products and machinery that are more efficiently produced elsewhere.

The comparative advantage of Mexico and Canada

Mexico’s climate allows it to produce agricultural products like fruits and vegetables efficiently, which it exports to Canada. In return, Canada exports vehicles, machinery, and mineral products to Mexico, utilizing its natural resources and skilled labor.

Comparative advantage formula

Curious about how to calculate comparative advantage? It’s all about opportunity cost. The formula is straightforward:

Opportunity Cost of Product A = Maximum Production of Product B / Maximum Production of Product A

This formula helps determine what must be given up to produce an additional unit of another product.

For example, if Country X can produce a maximum of 100 units of Product A or 200 units of Product B:

- Opportunity Cost of Producing 1 Unit of Product A = 200 / 100 = 2 Units of Product B

- Opportunity Cost of Producing 1 Unit of Product B = 100 / 200 = 0.5 Units of Product A

How to calculate comparative advantage

Let’s walk through a practical example using the U.S. and Saudi Arabia:

Maximum Production if all resources are allocated:

- The US: 100 cars or 25 barrels of crude oil per day

- Saudi Arabia: 15 cars or 150 barrels of crude oil per day

Calculating Opportunity Costs:

- The US:

- Opportunity Cost of 1 Car = 25 / 100 = 0.25 barrels of crude oil

- Opportunity Cost of 1 Barrel of Crude Oil = 100 / 25 = 4 cars

- Saudi Arabia:

- Opportunity Cost of 1 Car = 150 / 15 = 10 barrels of crude oil

- Opportunity Cost of 1 Barrel of Crude Oil = 15 / 150 = 0.1 cars

Conclusion: The US has a lower opportunity cost in producing cars, while Saudi Arabia has a lower opportunity cost in producing crude oil. Therefore, it benefits both countries if the US specializes in cars and Saudi Arabia specializes in crude oil, and they trade with each other.

Graph

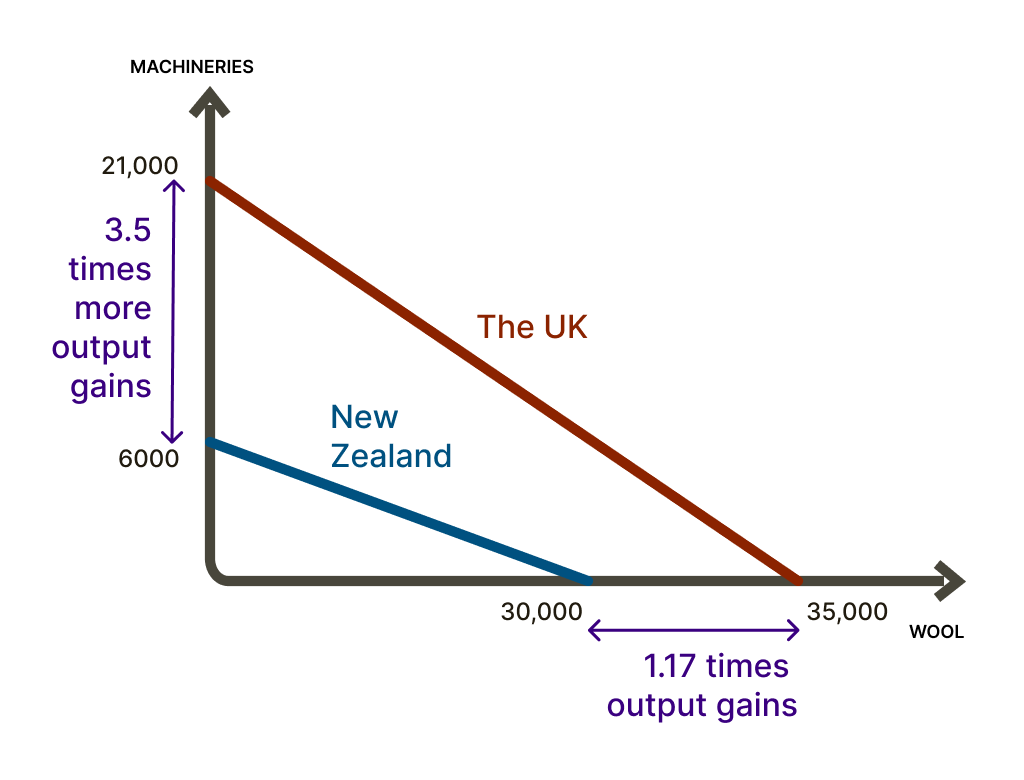

To visualize comparative advantage, economists use the Production Possibility Frontier (PPF). It’s a graph that shows the maximum possible production levels of two commodities for a country, given its resources and technology.

Example

Consider New Zealand and the United Kingdom (UK) producing wool and machinery:

Maximum Production if all resources are allocated:

- New Zealand: 30,000 metric tonnes of wool or 6,000 units of machinery per year

- UK: 35,000 metric tonnes of wool or 21,000 units of machinery per year

Although the UK has an absolute advantage in producing both goods, the comparative advantage is determined by calculating opportunity costs.

Calculating Opportunity Costs:

- New Zealand:

- Opportunity Cost of 1 Metric Tonne of Wool = 6,000 / 30,000 = 0.2 units of machinery

- Opportunity Cost of 1 Unit of Machinery = 30,000 / 6,000 = 5 metric tonnes of wool

- UK:

- Opportunity Cost of 1 Metric Tonne of Wool = 21,000 / 35,000 = 0.6 units of machinery

- Opportunity Cost of 1 Unit of Machinery = 35,000 / 21,000 = 1.67 metric tonnes of wool

New Zealand has a lower opportunity cost for producing wool, while the UK has a lower opportunity cost for producing machinery. This suggests that New Zealand should specialize in wool, and the UK should specialize in machinery.

Comparative advantage vs absolute advantage

It’s essential to distinguish between comparative advantage and absolute advantage. Absolute advantage refers to the ability of a country to produce a good more efficiently (using fewer resources) than another country. However, even if a country holds an absolute advantage, it can still benefit from specializing based on comparative advantage.

What is comparative advantage and absolute advantage?

Absolute Advantage: When a country can produce a good more efficiently than another country. For example, the U.S. may produce cars more efficiently due to advanced technology and skilled labor.

Comparative Advantage: When a country can produce a good at a lower opportunity cost than another country. It’s about what you sacrifice in producing one good over another. Even if a country is less efficient in producing all goods (no absolute advantage), it can still have a comparative advantage.

Why choose comparative advantage over absolute advantage?

- Cost Efficiency: Producing better quality may not be cost-effective if the opportunity cost is high.

- Market Demand: There may be limited demand for high-quality, high-cost products.

- Logistical Constraints: Distance and transportation costs can offset the benefits of absolute advantage.

By focusing on comparative advantage, countries can optimize their production and trade for mutual benefit.

Comparative advantage vs competitive advantage

While comparative advantage is about specializing in goods with the lowest opportunity cost, competitive advantage involves creating value that distinguishes a company or country from its competitors. It’s about offering better prices, higher quality, or unique features that attract customers.

To achieve competitive advantage, one might:

- Offer lower prices: Be the cost leader in the market.

- Provide superior quality: Deliver products or services that justify a premium price.

- Target a niche market: Serve a specific segment more effectively than competitors.

Competitive advantage focuses on differentiation and market positioning, while comparative advantage focuses on efficiency and opportunity cost.

Misconceptions

Let’s clear up some common misconceptions about comparative advantage:

- It’s always present between two countries: Not necessarily. Comparative advantage can change due to shifts in resources, technology, or external factors.

- It’s static: Comparative advantage evolves over time as countries develop and resources change.

- It determines trade winners and losers: While it guides beneficial trade, outcomes also depend on other variables like trade policies, global demand, and economic stability.

FAQs

Who has the comparative advantage in the production of corn?

The United States has a comparative advantage in the production of corn. According to Atlasbig.com, the U.S. is the largest producer of corn worldwide, with a volume of 384,777,890 tonnes per year. This abundance allows the U.S. to export corn efficiently.

Is comparative advantage good?

Yes, comparative advantage is beneficial as it promotes efficiency and productivity. By specializing in goods and services where they have an edge, countries can produce more using the same resources. This specialization leads to increased global trade, economic growth, and better allocation of resources. However, it’s essential to manage potential downsides like over-reliance on a single industry or exploitation of labor.

Takeaways

Understanding comparative advantage isn’t just for economists or policymakers; it’s a valuable concept that affects global trade and economies. By examining real-world examples and the underlying theory, we see how countries (and businesses) can benefit from specializing in what they do best and trading for the rest. This specialization leads to more efficient production, economic growth, and potentially better outcomes for everyone involved. So, the next time you’re weighing options—be it in business or personal decisions—consider your comparative advantages and how they can lead to greater success.