So, you’re knee-deep in financial statements, dodging accounting jargon like it’s dodgeball in gym class, and suddenly you’re hit with the million-dollar question: Is revenue an asset or equity?

Don’t sweat it—you’re not alone in this financial conundrum. It’s a question that trips up many entrepreneurs, especially those who’d rather wrestle with a spreadsheet than read an accounting textbook.

Here’s the short answer: Revenue is neither an asset nor equity. Think of it this way: on the balance sheet, assets, liabilities, and equity are having a party, but revenue didn’t make the guest list. Instead, revenue is partying over on the Statement of operations (income statement), showing off at the very top of the page.

Intrigued? Good. In this article, we’ll break down what revenue really is, how it fits into your financial statements, and why it’s not an asset or equity—but still influences both.

Related: Return on assets

What Is Revenue?

Imagine revenue as the lifeblood of your business—it’s the money rolling in from doing what you do best. Selling awesome products, providing top-notch services, or even renting out that spare office space for an impromptu yoga class—you name it, that’s revenue.

In fancy terms, it’s the gross income returned from your company’s operations, calculated as:

Average Sales Price × Number of Units Sold

Sounds like something straight out of a finance textbook, but really, it’s just counting the cash from your sales before expenses start nibbling away at it like termites on a wooden chair.

Revenue struts its stuff at the very top of your income statement, earning the nickname “the top line.” It’s the headliner, the main act, the superstar of your financial performance!

Now, don’t confuse revenue with net income. Net income, also known as the “bottom line,” is what’s left after subtracting all those pesky expenses, taxes, and other financial vampires that drain your hard-earned cash. Think of net income as what’s left in your pocket after paying all the bills.

So, if you want to make your shareholders dance like nobody’s watching, you need to:

- Increase revenue

- Cut expenses

- Or, if you’re feeling ambitious, do both!

Investors keep a keen eye on both revenue and net income when sizing up a company’s financial health. Why? Because a company can boost net income even if revenue is stagnant, simply by tightening the belt on costs (like ditching the fancy office coffee machine). That’s why revenues and earnings per share (EPS) grab all the headlines when public companies report their quarterly earnings. It’s the financial equivalent of a blockbuster movie release.

How You Recognize Revenue (Accounting Methods)

Now, let’s talk accounting methods. How you recognize revenue can depend on whether you’re using:

- Accrual Accounting: Revenue is recognized when the sale is made or the service is provided—even if you haven’t seen a dime yet. Sold goods on credit? That’s still revenue, my friend. Your bank account might disagree, but your income statement is all smiles.

- Cash Basis Accounting: Only recognizes revenue when the cash actually lands in your account. No cash, no revenue. Simple, but it might not tell the whole story if you’ve got a stack of unpaid invoices gathering dust.

But wait, there’s more! A company can have cash receipts without revenue. How’s that possible? Imagine a customer pays you in advance for a service you haven’t provided yet or for goods you haven’t delivered. That’s cash in your pocket (sweet!) but it’s not revenue—not yet anyway. In accounting land, this is called unearned revenue, and it sits on your balance sheet under liabilities until you deliver the goods or services.

Revenue Account

In the wonderful world of accounting, every transaction gets its own VIP pass. Revenue has its own exclusive spot—the revenue account. This is where all the money you earn from business transactions hangs out, waiting to impress investors and stakeholders (think of it as the green room before the big show).

On your income statement, the revenue account showcases how well your business is performing in the spotlight. High revenue turnover? You’re selling out stadiums. Low turnover? Maybe it’s time to remix your strategy.

In a double-entry bookkeeping system (don’t worry, it’s not as scary as it sounds), revenue accounts are general ledger accounts that get summarized on your income statement under “Revenue” or “Revenues.” You’ll see descriptions like Repair Service Revenue, Rent Revenue Earned, or just plain ol’ Sales (like your greatest hits album).

So, what gets into this VIP lounge? All the moneymakers, including:

- Services rendered

- Sales

- Rental income

- Membership fees

- Recurring charges

- Interest from investments

- Donations

In the income statement, revenues are generally split into two categories: operating revenues and non-operating revenues.

Types of Revenue:

- Operating Revenue: This is your bread and butter—the money your company earns from its core business operations. If you’re a baker, it’s the dough (pun intended) from selling your delectable pastries. If you’re an app developer, it’s income from app sales or subscriptions. Generally, operating revenue forms the bulk of a company’s total income.

- Non-Operating Revenue: This is the side hustle income—the money earned from activities outside your main business operations. Think interest income from investments, dividend income, or profits from selling an asset (like that old company van that finally gave up the ghost).

Here’s a quick list of revenue account subgroups:

- Interest income

- Dividend income

- Investment income

- Service revenue

- Sales revenue

- Rent income

Now that we’ve got a grip on what revenue is, let’s tackle the big question: Is revenue an asset or equity? To answer that, we’ll need to dive into what assets and equity are in a company’s financial statements.

See also: Is preferred stock an asset?

What Are Assets?

Alright, let’s dive into the world of assets—the shiny things your company owns, expecting them to bring future economic benefits. Think of assets as the valuable resources or rights that your business owns or controls, which help you generate income and reduce expenses. They’re like your company’s Swiss Army knife, treasure chest, and secret weapon all rolled into one.

Assets can boost your operations, increase your business’s value, and even bump up your personal net worth if you’re the owner. Generally, a business with a high proportion of assets compared to liabilities is sitting pretty—that’s because more assets mean a higher degree of liquidity (like having a stash of cash under the mattress).

But here’s the kicker: to acquire more assets, companies often use their revenue or take on liabilities (like loans). So while revenue isn’t an asset itself, it sure can help you get more assets. And guess what? Those assets can then be used to generate even more revenue. It’s the circle of (business) life!

So, while revenue and assets both can increase the value of a business, revenue isn’t a type of asset. Instead, it’s used to invest in assets, which then help generate more revenue. It’s like planting seeds (revenue) to grow a money tree (assets) that bears fruit (more revenue).

What Is Equity?

Now, let’s unravel the mystery of equity—the owner’s piece of the pie. Equity, often called shareholders’ equity (or owners’ equity for privately held companies), shows up on the balance sheet and represents the amount of money that would be returned to shareholders if all the assets were liquidated and all the debts paid off. It’s basically what’s left over—the leftovers after the financial feast.

Think of equity as your company’s net worth. It’s calculated as:

Equity = Assets – Liabilities

So, if you’re wondering who really owns the company, equity holds the answer. It’s the financial stake that the owners or shareholders have in the company—their skin in the game.

Equity is crucial because it’s the portion of the company’s assets that owners fully own, free and clear. This could be cash, buildings, equipment—whatever assets the company has without any liens or debts attached.

Now, revenue isn’t equity, but it does have an impact on shareholders’ equity on the balance sheet. How? Well, when you use revenue to increase assets (like buying new equipment), you’re also boosting equity. Plus, revenue can be used to pay dividends to shareholders, which affects retained earnings—a component of equity. Think of it as reinvesting your profits back into the business, or sharing the spoils with your fellow stakeholders.

See also: Accumulated depreciation on balance sheet

Is Revenue an Asset or Equity?

Let’s cut to the chase: Nope, revenue is neither an asset nor equity.

Wait, what?

If you’ve been scouring your balance sheet looking for that glorious revenue figure, you’re on a wild goose chase. Revenue doesn’t live on the balance sheet with your assets, liabilities, and equity. Instead, it hangs out on the income statement, strutting its stuff at the very top like it owns the place.

So, why isn’t revenue an asset or equity?

Well, revenue represents the money your company earns from its normal business operations—it’s the inflow of economic benefits from activities like selling goods or providing services. It’s not something your company owns (like assets), nor is it a residual interest in the company’s assets after deducting liabilities (like equity). Think of revenue as the party starter—it gets things moving but isn’t part of the final tally.

But here’s the twist: Even though revenue isn’t an asset or equity, it still impacts both.

When you make a sale, several things happen:

- If you receive cash immediately, your Cash account (an asset) increases.

- If the customer buys on credit, your Accounts Receivable (also an asset) increases.

- Meanwhile, on the income statement, your Revenue account increases.

In a double-entry accounting system (don’t panic—it’s just the method where every transaction affects at least two accounts), these entries keep everything in balance. It’s accounting’s way of making sure every action has an equal and opposite reaction.

But wait, there’s more!

Revenue also impacts equity through retained earnings. When you earn revenue, your net income increases (assuming expenses don’t eat it all up like a hungry hippo). At the end of the accounting period, net income flows into Retained Earnings, which is a component of shareholders’ equity.

So, while revenue isn’t recorded on the balance sheet like assets and equity, it’s the starting point that eventually affects both. It’s the pebble that creates ripples across your financial pond.

Let’s look at an example to see how this plays out in real life.

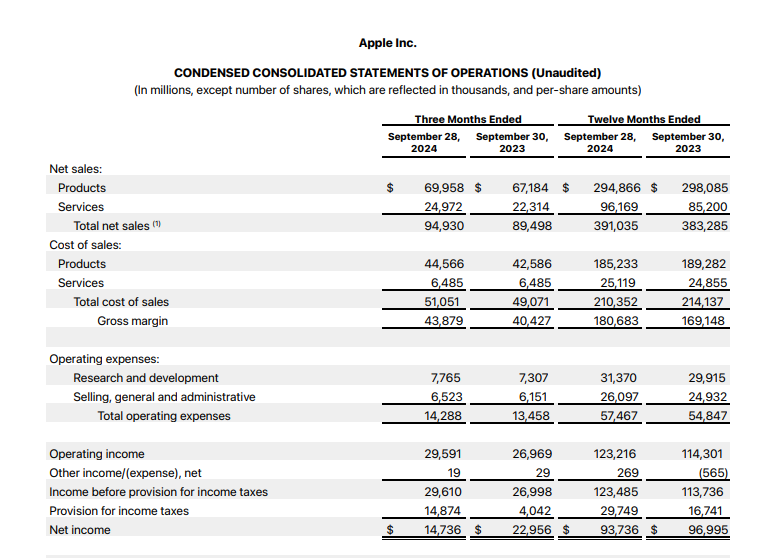

Using APPLE financials as an example, below is an excerpt of Statement of operations (income statement) and balance sheet:

As you can see, revenue appears at the top of the income statement—not the balance sheet.

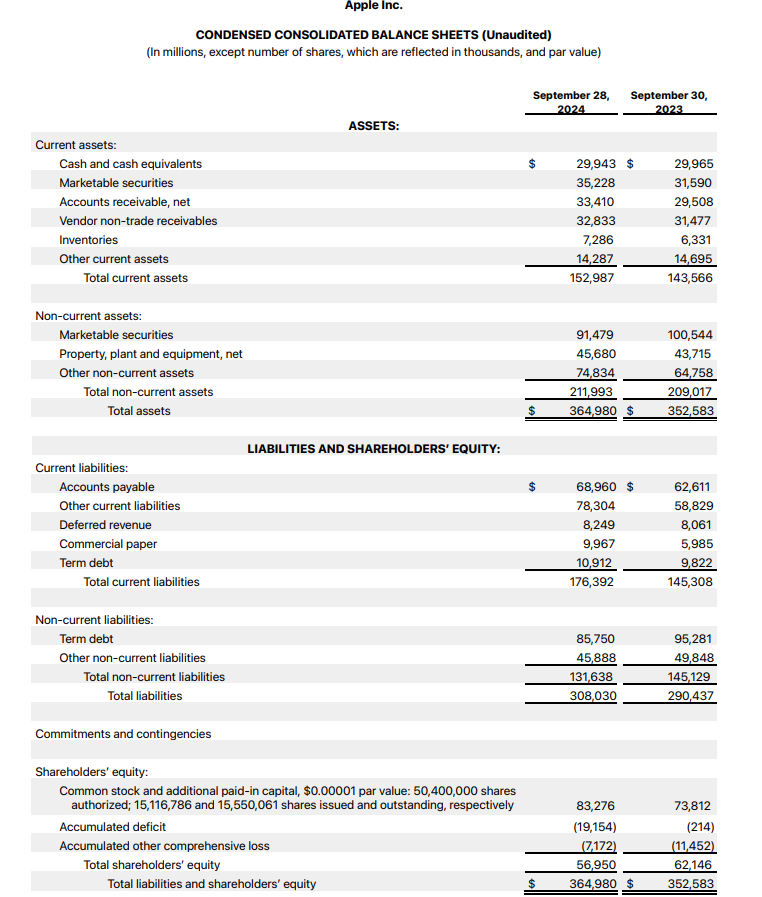

Now, check out the balance sheet:

Assets, liabilities, and equity are all there, but revenue is nowhere to be found.

But remember, revenue does affect the balance sheet indirectly. When revenue increases, it can lead to an increase in assets (like cash or accounts receivable) and an increase in equity (through retained earnings).

So, in summary:

- Revenue is recorded on the income statement.

- Assets and equity are recorded on the balance sheet.

- Revenue is not an asset or equity, but it impacts both.

See also: What are equity stocks?

Why Revenue Is Not an Asset or Equity

So, why isn’t revenue considered an asset or equity? Let’s break it down.

First off, in accounting, revenue has its own special account. It’s the total amount of income generated from the sale of goods and services associated with the primary operations of a business—the cash coming in from doing what you do best.

At the end of the accounting period, the balances in the revenue accounts are closed out and transferred to the capital account, which increases the owner’s equity. So, while revenue contributes to an increase in equity, it isn’t equity itself. Think of it as adding fuel to the fire—it boosts the heat but isn’t the fire itself.

Furthermore, revenue isn’t an asset because it’s not something the company owns or controls in the way it owns cash, equipment, or inventory. Instead, revenue represents the earnings from operations that can be used to invest in assets, pay off liabilities, or distribute dividends to shareholders. It’s the inflow of economic benefits, not the benefits themselves.

Each of these accounts serves a unique purpose, and revenue is just one piece of the puzzle—not an asset or equity, but a contributor to both.

Takeaways

Alright, let’s wrap this up with some key points to remember:

- Revenue is neither an asset nor equity. It’s the income generated from normal business operations and is recorded on the Statement of operations (income statement).

- Assets are resources owned by a company that have economic value and can provide future benefits. They show up on the balance sheet.

- Equity represents the owners’ stake in the company, calculated as total assets minus total liabilities. It’s also found on the balance sheet.

- Revenue impacts both assets and equity indirectly. Earning revenue can increase assets like cash or accounts receivable and boosts equity through increased net income and retained earnings.

- Understanding the differences between revenue, assets, and equity is crucial for accurately interpreting financial statements and assessing a company’s financial health.

That’s it! Now you’re armed with the knowledge to navigate your financial statements like a pro. Go forth and dazzle your accountant (or at least understand what they’re talking about).