Preferred Stock Advantages and Disadvantages

So, you’re thinking about jumping into the world of preferred stocks, huh? Well, pull up a chair and maybe grab a coffee (or something stronger), because we’re about to dive into the quirks, perks, and potential pitfalls of these financial chameleons. Companies often issue preferred stock when they need a financial boost—kind of like hitting up your rich uncle for a loan, but without the awkward family reunions. Investors, on the other hand, are usually lured in by the promise of those sweet, sweet regular dividend payments.

In a nutshell, preferred stock is like the middle child of the stock market family. It represents ownership in a company—just like common stock—but with some special perks (and quirks). Think of it as a hybrid between stocks and bonds. Why? Because it has traits of both: the potential for your investment to appreciate over time (yay, equity!) and the promise of fixed, regular dividends (hello, debt vibes).

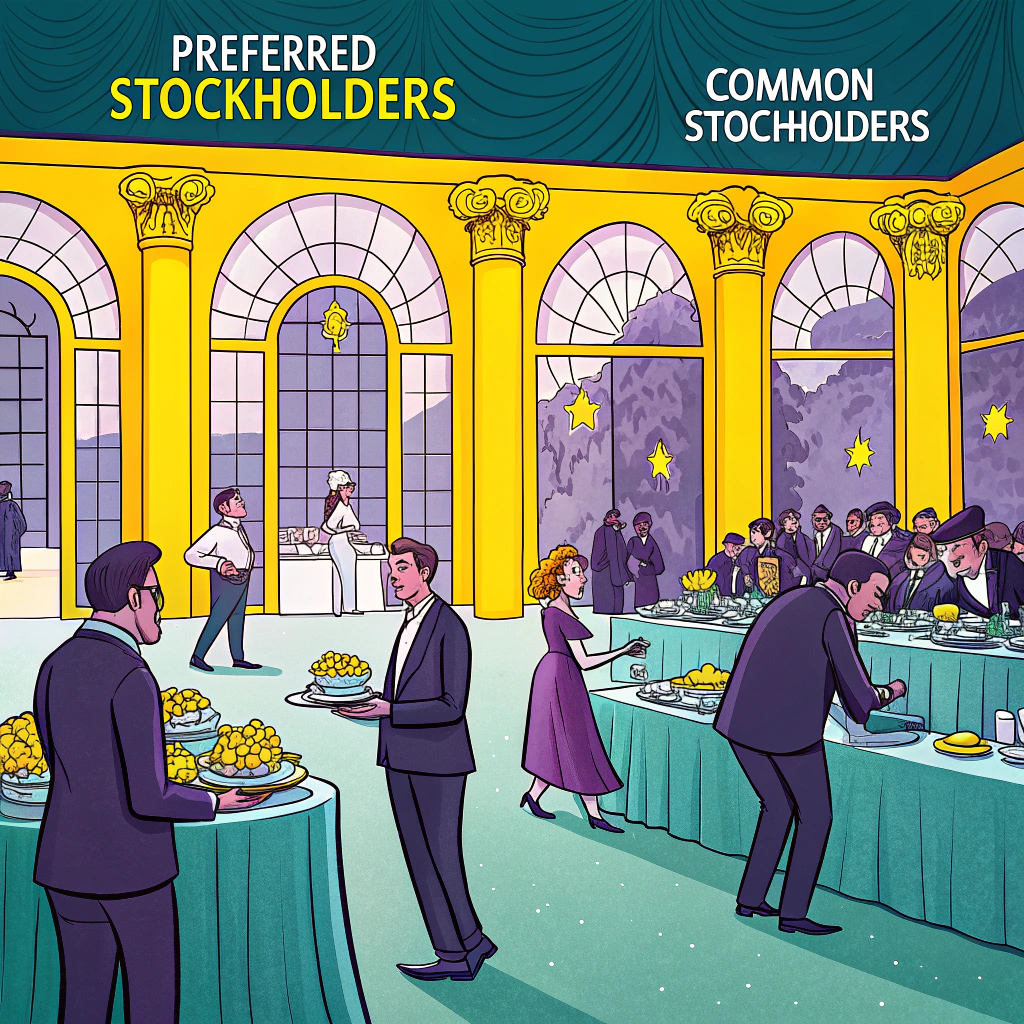

And here’s the kicker: when it’s time for the company to dish out dividends, preferred stockholders are like VIP guests—they get served first. Common stockholders? They get what’s left—if there’s anything left. If the party punch bowl runs dry, common stockholders are out of luck.

Now, preferred stocks aren’t as popular as their common stock siblings—not every company bothers with them. When they are issued, preferred shares typically make up a smaller slice of the company’s total share pie. But don’t worry, you can still find them trading in the big leagues like NASDAQ (National Association of Securities Dealers Automated Quotations Stock Market) and the NYSE (New York Stock Exchange), often sporting their own fancy ticker symbols to stand out from the crowd.

Preferred stocks come in all shapes and sizes—cumulative, participating, convertible—you name it. It’s like the ice cream shop of the stock market, but instead of 31 flavors, you’ve got options like adjustable-rate, perpetual, and even putable preferred stocks. A little something for everyone’s palate.

Here’s another perk: if the company hits rough waters—think bankruptcy, mergers, or liquidation—preferred stockholders have a higher claim on the company’s assets than the common stockholders. It’s like having a slightly better seat on the Titanic. Oh, and in case you’re wondering, preferred stocks also go by “preferred shares” or just “preferred.”

See also: Large-cap, mid-cap, and small-cap stocks

Preferred Stock Advantages and Disadvantages

Now, let’s get down to brass tacks—the advantages and disadvantages of preferred stocks. These pros and cons affect both the companies issuing them and the investors buying them. We’ll lay them out in the table below and then dive into the juicy details afterward.

| Advantages | Disadvantages |

|---|---|

| Company retains full control | Obligated to pay preferred stockholders dividends |

| Stockholders enjoy fixed and regular dividends | Can’t participate in higher dividend payouts due to fixed rate |

| Priority claim on assets during liquidation | No voting rights in the company |

| Ownership stake in the company | Preferred stocks are relatively expensive |

| Provides permanent funding to the company | Dividends paid in arrears to cumulative preferred stockholders |

| Company can defer dividend payments |

Advantages of Preferred Stock

Issuing preferred stocks can offer a treasure trove of advantages, both for the companies rolling them out and the investors snapping them up. Let’s break down these perks:

| Issuing Company | Investors |

|---|---|

| Full Control Maintained: The company calls the shots without interference from preferred shareholders. | Fixed Income Stream: Investors enjoy regular, predictable dividend payments. |

| Permanent Capital Source: Brings in long-term funding without repayment obligations. | Priority Dividends: Get paid before common stockholders. |

| Flexible Terms: Companies can set the terms to suit their needs. | Ownership Stake: Investors still own a slice of the company. |

| Dividend Deferral Option: Can postpone dividends when necessary. | Priority Claim on Assets: Higher claim if the company goes under. |

| Cost Savings: Fixed dividends help manage expenses. | Convertible Options: Potential to convert to common stock. |

| Potential Buyback Gains: Profit if the company repurchases the stock. |

Why Companies Love Preferred Stock: Keeping Control and Raising Cash

- Full Control Maintained: Unlike common stockholders, who love to throw their voting weight around, preferred stockholders are generally silent partners. They don’t have voting rights, so the company can keep steering the ship without backseat drivers.

- Permanent Capital Source: Preferred stocks contribute to the company’s share capital and don’t have a maturity date—meaning the company doesn’t have to pay the money back. It’s like a financial gift that keeps on giving, without the awkward thank-you notes.

- Flexible Terms: Preferred stocks are like build-your-own pizzas—the company can customize the terms in the prospectus to suit their needs. Want to add an extra topping of redemption rights or sprinkle in some conversion features? Go ahead!

- Dividend Deferral Option: Feeling a financial crunch? Companies can defer dividend payments on preferred stocks to a later date. It’s like hitting the snooze button on a financial alarm clock.

- Cost Savings: With fixed dividends, companies won’t have to shell out extra cash when profits soar. They save money by not having to pay higher dividends. Share the wealth? Maybe next time.

Why Investors Dig Preferred Stock: Steady Income and Priority Treatment

- Fixed Income Stream: Preferred stocks offer investors regular, predictable dividend payments. It’s like getting a paycheck without having to show up for work. Who wouldn’t love that?

- Priority Dividends: When it’s time to divvy up dividends, preferred stockholders are first in line. Common stockholders can wait their turn. It’s good to be at the front of the queue.

- Ownership Stake: Even without voting rights, preferred stockholders still own a piece of the company. It’s like being part of an exclusive club—with benefits.

- Priority Claim on Assets: If the company decides to throw in the towel, preferred stockholders have a higher claim on assets than common stockholders. It’s a small consolation, but better than nothing.

- Convertible Options: Some preferred stocks can be converted into common stocks, offering potential for capital gains if the common stock price takes off. Cha-ching!

- Potential Buyback Gains: If the company decides to buy back the preferred stock at a premium, investors can pocket the difference. It’s like finding money in your old jeans—pleasant surprise!

Disadvantages of Preferred Stock

Of course, it’s not all sunshine and rainbows. Preferred stocks come with their own set of drawbacks for both companies and investors. Let’s lay them out:

| Issuing Company | Stockholder |

|---|---|

| Dividend Obligations: Companies must keep up with dividend payments. | No Voting Rights: Investors typically don’t have a say in company decisions. |

| Accumulation of Unpaid Dividends: For cumulative preferred stocks, missed dividends add up and must be paid eventually. | No Dividend Increases: Fixed dividends mean missing out on higher payouts when profits soar. |

| Higher Cost: Preferred stocks are generally more expensive than common stocks. |

Why Companies Might Think Twice: The Financial Burden of Dividends

- Dividend Obligations: Preferred dividends are like that gym membership—you’ve got to keep paying, whether you feel like it or not. Companies are obligated to pay these dividends, which can be a financial strain, especially during lean times.

- Accumulation of Unpaid Dividends: If the company can’t pay dividends on cumulative preferred stocks, those unpaid dividends don’t just disappear. They pile up like dirty dishes in the sink, and the company will have to deal with them eventually.

Why Investors Should Proceed with Caution: Limited Rights and Potential Missed Opportunities

- No Voting Rights: Preferred stockholders are like silent partners—they own a piece of the company but don’t get a say in how it’s run. If you were hoping to vote out the CEO, think again.

- No Dividend Increases: With fixed dividends, investors won’t see higher payouts even if the company’s profits skyrocket. It’s like having a fixed-rate coupon in a world of variable-rate excitement.

- Higher Cost: Preferred stocks often come with a higher price tag compared to common stocks. It’s an upfront cost that might deter some investors.

See also: Advantages and disadvantages of share buyback

Takeaways

So, what’s the final verdict on preferred stocks? They’re a mixed bag—offering both companies and investors a blend of benefits and drawbacks. For companies, preferred stocks provide a handy way to raise permanent capital without diluting control, but they come with the responsibility of regular dividend payments. For investors, they offer a steady income and priority treatment, but at the cost of voting rights and potential missed opportunities for higher returns.

Whether you’re an investor eyeing that regular dividend check or a company contemplating issuing preferred stock to fund your next big project, it’s crucial to weigh these pros and cons carefully. Like any financial decision, knowledge is power. So arm yourself with the facts, maybe re-read this article (we won’t judge), and make the choice that best suits your financial goals.

Remember, in the world of finance, nothing is ever a sure bet. But with a bit of savvy and a dash of courage, you might just find that preferred stocks are the right fit for your portfolio—or your company’s balance sheet.