Trusting your current ratio to pay the bills?

That’s like trying to pay your rent with a warehouse full of fidget spinners. Good luck explaining that to your landlord.

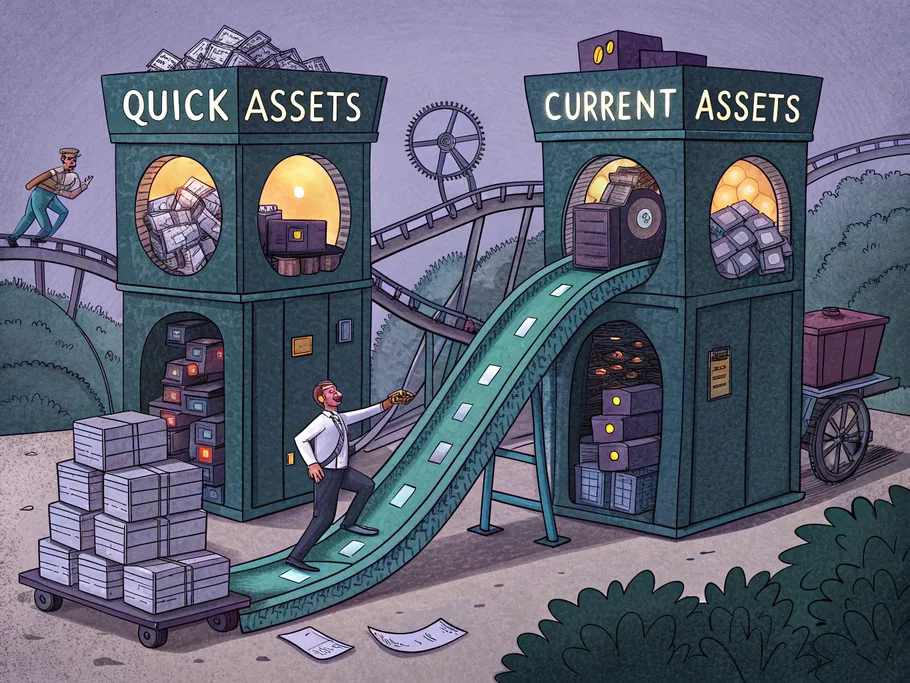

When you’re trying to figure out if a company can actually pay its debts, you’re dealing with liquidity ratios. Two of the biggest names in the game are the Quick Ratio and the Current Ratio. They sound similar, but they tell very different stories about a company’s financial health.

Let’s get into the difference between the quick ratio and current ratio.

What are the Quick and Current Ratios?

Think of these as two different ways to peek into a company’s wallet.

Quick Ratio (or Acid-Test Ratio) This is the tough, no-nonsense look at a company’s ability to cover its short-term bills using only its most liquid assets. We’re talking about the stuff that can be turned into cash, like, yesterday: cash, cash equivalents, marketable securities, and accounts receivable. The acid test ratio meaning is simple: it’s a stress test.

Current Ratio (or Working Capital Ratio) This one is a bit more relaxed. It measures a company’s ability to pay its short-term liabilities using all its current assets. That includes the quick stuff plus the slower-moving items like inventory and prepaid expenses.

The Core Difference: What’s in the Mix?

The fundamental difference between these liquidity ratios is what assets they decide to count.

- The current ratio is the optimist – it includes everything in the “current assets” bucket.

- The quick ratio is the skeptic – it kicks out inventory and prepaid expenses, focusing only on the assets that are practically cash already.

What’s an Ideal Ratio, Anyway?

While a ratio of 1.0 or higher is traditionally seen as a sign of good health, this number can be seriously misleading. A company might have a killer current ratio, but if a huge chunk of its assets is tied up in last season’s inventory that no one wants, its real-world liquidity is much weaker than the ratio suggests.

A ratio below 1.0 might flash a warning sign for liquidity problems, while a number way above 1.0 suggests the company is sitting pretty. But never take the number at face value without peeking under the hood.

Quick Ratio vs Current Ratio: The Head-to-Head Comparison

| Criteria | Quick Ratio | Current Ratio |

|---|---|---|

| Definition | Measures ability to meet short-term liabilities with most liquid assets. | Measures ability to pay short-term liabilities with all current assets. |

| Also known as | Acid-test ratio | Working capital ratio |

| Use | Determines ability to meet urgent debts with liquid assets. | Determines ability to meet current debts. |

| Formula | Quick ratio = Liquid assets / Current liabilities | Current ratio = Current Assets / Current Liabilities |

| Current Assets Included | Cash & cash equivalents, marketable securities, accounts receivable. | Cash & cash equivalents, marketable securities, accounts receivable, inventory, prepaid expenses. |

| Limitations | Doesn’t indicate future cash flow activity. Liquidity of accounts receivable and marketable securities can vary. | Lacks specificity, includes less liquid assets. Can be manipulated by management. |

The Formulas You Need

Here’s how to do the math.

Quick Ratio Formula

- Quick ratio = Liquid Assets / Current Liabilities

- Quick ratio = (Cash + Cash equivalents + Marketable securities + Accounts receivable) / Current liabilities

- Quick ratio = (Current assets – Inventory – Prepaid expenses) / Current liabilities

Current Ratio Formula

- Current ratio = Current Assets / Current Liabilities

Let’s See Them in Action

Numbers on a page are boring. Let’s see how this plays out in the real world.

Food Industry Throwdown

Company ABC and Company XYZ are competitors. They have identical assets and liabilities on paper, but their inventory situation is wildly different.

| Balance Sheet Items | Company ABC | Company XYZ |

|---|---|---|

| Total Current Assets | $105,000 | $105,000 |

| Total Current Liabilities | $130,000 | $130,000 |

| Inventory | $60,000 | $2,000 |

Current Ratio Calculation:

- Company ABC: $105,000 ÷ $130,000 = 0.807

- Company XYZ: $105,000 ÷ $130,000 = 0.807

See? Their current ratios are identical. But wait…

Quick Ratio Calculation:

- Company ABC: ($105,000 – $60,000) ÷ $130,000 = 0.346

- Company XYZ: ($105,000 – $2,000) ÷ $130,000 = 0.79

Analysis: Now we see the truth. Both companies look the same on the surface, but Company XYZ is in a much stronger position with a quick ratio of 0.79. Its low inventory means it can cover its debts far more easily than Company ABC, which is sitting on a mountain of stock.

Tech Firm Analysis

A tech company has $170,000 in current liabilities and the following assets:

| Assets | Amount |

|---|---|

| Total Current Assets | $260,000 |

| Inventory | $60,000 |

| Prepaid Insurance | $15,000 |

Calculations:

- Quick ratio = ($260,000 – $60,000 – $15,000) ÷ $170,000 = 1.08

- Current ratio = $260,000 ÷ $170,000 = 1.52

Analysis: Both ratios are over 1.0, which is a great sign. The current ratio of 1.52 shows they have plenty of assets overall, and the quick ratio interpretation of 1.08 confirms they have enough fast cash on hand to handle immediate needs without having to sell off their inventory.

So, When to Use Quick Ratio vs Current Ratio?

Choosing which ratio is “more useful” isn’t about finding one perfect answer. It’s a thoughtful reminder that the best tool depends on the job. Taking the time to understand the specific situation will quietly show you the right path.

The quick ratio gives you a more conservative, almost pessimistic, assessment. It’s your best friend when you’re looking at:

- Companies with a ton of inventory (think retailers or manufacturers).

- Industries where inventory can become obsolete fast (hello, fashion and tech).

- Situations where you need an urgent, worst-case-scenario liquidity check.

The current ratio offers a wider, more optimistic view. It works well for:

- Companies where inventory is basically as good as cash (like high-demand commodities).

- Getting a general, big-picture sense of financial health.

- Comparing a company to its direct competitors.

The Liquidity Ratio Spectrum: Current Ratio vs Quick Ratio vs Cash Ratio

It helps to think of these ratios on a scale from most to least strict.

- Cash Ratio: The ultimate hardass. It only counts cash and cash equivalents.

- Quick Ratio: The firm-but-fair middle ground. It kicks out inventory.

- Current Ratio: The most lenient. It includes all current assets.

The Bottom Line

Both the quick ratio and the current ratio are essential tools. One isn’t better than the other; they just tell you different things.

The quick ratio is your stringent stress test, while the current ratio gives you the full landscape view. For a truly smart analysis, you need to use both, compare them to industry benchmarks, and consider the unique context of the company.

Because knowing the difference is what separates a smart financial read from just hoping for the best.