Picture this: Alex, a sharp entrepreneur, spots a golden opportunity to scale their logistics company. They take out a hefty loan for a brand-new fleet of delivery vehicles, a bold move promising to triple their capacity. They built their dream on what seemed like solid ground, believing growth was a straight line pointing up.

But the world turned. Just months later, an unexpected economic downturn hits. Fuel costs explode, shipping demand dries up, and the market value of their specialized fleet plummets.

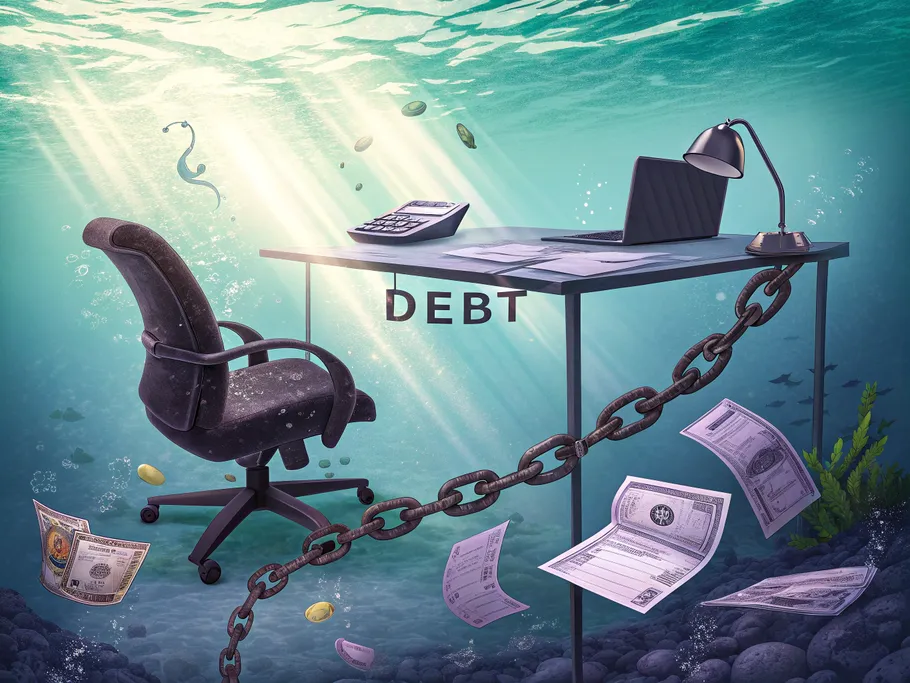

Suddenly, the very asset meant to lift them became a heavy chain. The outstanding loan is now a crushing weight, far heavier than what the vehicles are worth.

Alex is trapped in negative equity – a crisis threatening their cash flow, creditworthiness, and the very survival of their business.

What is Negative Equity? Let’s Unpack It

First, let’s get a handle on the equity definition.

At its core, equity is the value of an asset once you subtract any debts tied to it. It’s the part you actually own. You’ll see it in a few key places:

- Corporate Finance: The difference between a company’s total assets and total liabilities. This is your negative shareholder equity when it goes wrong.

- Real Estate: The gap between a property’s market value and the outstanding mortgage. This is a big one for negative equity real estate.

- Stock Market: The shares owned by investors in a company.

Simple enough, right? But what happens when that value sinks?

Defining Negative Equity: Going Underwater

So, what is negative equity? It’s the financial chokehold that happens when an asset’s current market value drops below the remaining balance on the loan you used to buy it. It’s often called being “underwater” on a loan, and it feels exactly like it sounds.

The formula is a gut punch:

Market Value < Outstanding Loan Balance = Negative Equity

This is the trap Alex fell into. The fleet’s market value sank below the loan amount, leaving the company financially exposed and gasping for air.

How We All Fall into the Trap

So, what causes negative equity? It isn’t just bad luck; it’s usually a tag team of two powerful forces.

- Economic Downturns: Recessions and market crashes can torpedo asset values with shocking speed. The 2008 housing crisis was a masterclass in this, with property values in some areas falling by as much as 60%, leaving millions of homeowners owing more than their homes were worth.

- Depreciation: This is the slow, silent killer. Assets like vehicles and equipment naturally lose value over time. Trying to outrun depreciation with your standard monthly payments is like trying to bail out a sinking ship with a teacup. If your loan principal doesn’t shrink faster than the asset’s value, you’re on a collision course with negative equity.

And this isn’t some abstract risk. In the auto world, for example, a staggering 39% of drivers with financed vehicles were underwater in late 2024. What does negative equity mean on a car? It means you owe more than it’s worth, and selling it would still leave you in debt.

The Three Faces of Negative Equity

Negative equity can show up in a few different, equally unpleasant ways:

- Company-Level (Negative Shareholder Equity): This is what negative shareholder equity is all about. It’s when a company’s total liabilities are greater than its total assets, signaling severe financial distress.

- Asset-Level (Cars, Property, Equipment): A specific asset is underwater. This is a direct hit to your cash flow if you need to sell and makes it useless as collateral for other loans.

- Personal-Level: When your personal mortgage, student loans, and credit card debt add up to more than the value of everything you own. A serious threat to your financial stability.

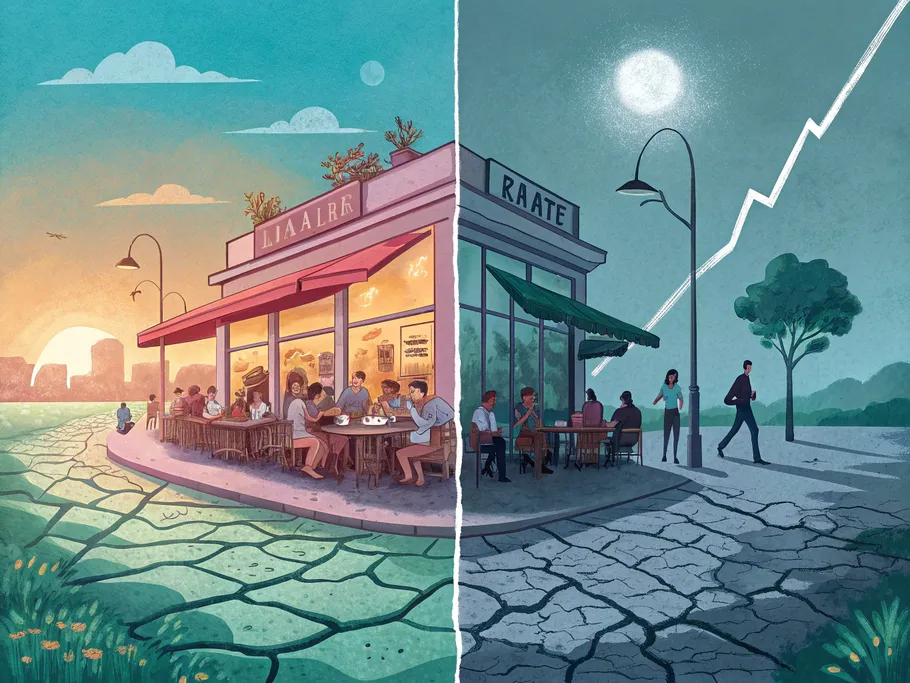

Positive Equity vs Negative Equity: A Tale of Two Scenarios

The goal is always positive equity. This is the promised land where an asset’s market value is higher than the loan balance. It’s true ownership. It’s leverage for your next big move. It’s cash in your pocket if you decide to sell.

Let’s look at a clear negative equity real estate example.

Imagine a business buys a commercial property for $1,000,000:

Positive Equity Scenario:

After three years in a strong market:

$1,300,000 (market value) – $600,000 (outstanding balance) = $700,000 in positive equity

Negative Equity Scenario:

In a declining market:

$500,000 (market value) – $600,000 (outstanding balance) = -$100,000 in negative equity

Your Strategic Toolkit: Know Your Numbers

Get familiar with these terms:

- Outstanding debt: The total you owe lenders, including the remaining principal and any unpaid interest.

- Negative shareholder equity: The corporate red alert when total liabilities are more than total assets.

Here’s how to calculate equity for your key assets:

For Real Estate: Current Market Value – Remaining Mortgage Balance = Equity

For Vehicles: Current Market Value (check Kelley Blue Book or Edmunds) – Outstanding Car Loan Balance = Equity

For Your Business: Look at your balance sheet’s “Total Equity” or “Shareholders’ Equity” line. If that number is negative, the whole company is underwater.

How to Avoid Negative Equity and Stay Afloat

Want to dodge this trap? It’s about playing smart from the start.

Substantial Down Payments Putting more money down upfront shrinks your loan and creates an instant equity buffer. This is your first line of defense against market dips and depreciation.

Accelerated Repayments Make extra payments toward the principal. This pays down your debt faster than the asset can lose value, which is absolutely critical for things that depreciate quickly, like vehicles.

Strategic Asset Management Do your homework before you buy. Understand how an asset depreciates and how volatile its market is. Keep an eye on the value of your major assets to monitor your equity.

Prudent Debt Management Don’t get over-leveraged. Maintain a healthy debt-to-asset ratio in both your business and personal finances. The more debt you carry, the more vulnerable you are to the shocks that create negative equity.

Understanding and actively managing your equity is your best defense against the underwater trap. It’s what keeps your head above water and protects both your business and your financial security.