Ah, startups. Bless their ambitious hearts. They set out to change the world, but often get tripped up by the basics, like getting locked into insane monthly insurance premiums. Why? Because the term “prepayment options” sounded suspiciously like “responsible financial planning.”

It’s less of a delicate balancing act and more of a frantic scramble between keeping the lights on and making sure you’re actually covered if something goes sideways. So, let’s talk about a little trick that turns a boring expense into a secret weapon: prepaid insurance.

So, What Exactly is Prepaid Insurance?

In simple terms, the prepaid insurance definition is money you pay upfront to an insurer for future coverage. Think of it like pre-ordering a video game, but instead of fighting digital dragons, you’re protecting your vehicles, office, machinery, or even your team’s health.

Insurance companies love when you do this. While they happily accept monthly payments, they’ll often dangle a juicy discount for quarterly or annual lump-sum payments. It’s a win-win: they get a nice chunk of working capital, and you get to lock in a lower rate.

By paying in advance, you’re not just throwing cash away. You’re cleverly converting it into a resource that will benefit you later. This simple transaction is the key to understanding why prepaid insurance is an asset.

The Definition of Assets (The Not-Boring Version)

Forget the dusty textbook definition for a second. An asset is just something you own that will provide a future economic high-five, either by making you money or saving you money. Assets come in a few flavors:

- Tangible: Stuff you can kick, like buildings, equipment, or the company car.

- Intangible: Stuff you can’t touch but is still valuable, like patents or your killer brand logo.

Prepaid insurance falls into a special category called current assets. It’s not a physical thing, but it represents your right to a future service you’ve already paid for.

Yes, Prepaid Insurance Is an Asset. Here’s Why.

Let’s cut to the chase: is prepaid insurance an asset or expense? It starts as an asset.

Here’s the logic:

- You’ve paid for something that will reduce your expenses in the coming months. That makes it a valuable resource.

- Because it provides a future economic benefit (by saving you from monthly cash drains), it perfectly fits the definition of assets.

How Prepaid Insurance Shows Up on the Balance Sheet

When you’re doing your prepaid insurance accounting, its classification depends on the time frame:

- If the policy covers less than one year, your prepaid insurance on the balance sheet is listed as a current asset.

- If you’re a real go-getter and paid for more than 12 months, the portion of coverage extending beyond the one-year mark is classified as a long-term asset.

As time passes and you “use up” the insurance coverage, the value of the asset goes down. Each month, a portion of the prepaid amount gets converted into an “insurance expense” on your income statement. This process follows the accrual accounting “matching principle,” which is a fancy way of saying you record expenses in the period they actually happen.

Managing and Accounting for Prepaid Insurance

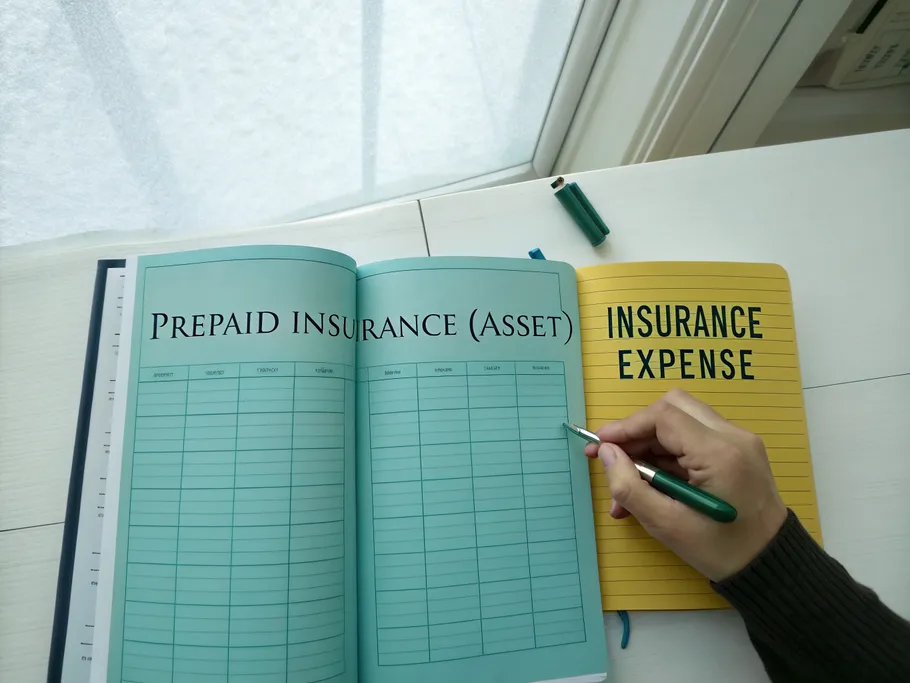

Here’s how the magic happens on your financial statements.

Recording the Initial Payment

When you first pay that lump sum, your books will show:

- An increase in your “Prepaid Insurance” asset account.

- A decrease in your “Cash” account.

You’ve essentially just swapped one asset (cold, hard cash) for another (the right to be covered later).

Making Monthly Adjustments

As each month of coverage passes, you need to make an adjusting journal entry. This moves one month’s worth of the premium from the “Prepaid Insurance” asset account over to the “Insurance Expense” account.

Regularly checking this ensures your prepaid insurance on the balance sheet accurately shows the remaining unused coverage.

Reporting and Disclosure

At the end of the day:

- The leftover balance of your prepaid insurance sits proudly under “Current Assets” on the balance sheet.

- The portion you’ve used up appears on the income statement as “Insurance Expense.”

- For total transparency, companies often add details about significant prepaid expenses in the footnotes of their financial statements.

Strategic Perks and Smart Uses

Optimizing Your Cash Flow

By prepaying, you kill a recurring monthly bill. This makes your budget more stable and financial forecasting way less of a guessing game.

Mitigating Risk and Staying Covered

Paying upfront means you’re covered, period. There’s no risk of your policy lapsing because someone forgot to make a monthly payment. This guarantees uninterrupted protection, which is critical for avoiding operational chaos.

Flexibility and a Way Out

Here’s a fun fact: prepaying doesn’t always mean you’re locked in forever. If your business needs change or you find a better deal elsewhere, you can often cancel the policy and get a refund for the unused portion.

However, a word of caution. Tying up capital in prepaid insurance can limit your liquidity, leaving less cash for other opportunities. According to research from happay.com, getting those refunds can sometimes be complex. So while prepayment stabilizes expenses, it might reduce your financial agility a bit.

Your Action Plan

Key Takeaways

- Prepaid insurance is an asset, not just an expense, because it’s a payment for a future benefit.

- It’s recorded as a current asset and then gradually moved to an expense as you use the coverage.

- Properly accounting for prepaid insurance gives you a clearer picture of your financial health.

Practical Steps to Get It Right

- Assess Your Options: Look at the discounts insurers offer for prepaying. Does the savings justify the upfront cash hit?

- Record the Entry: When you pay, correctly log it as a debit to Prepaid Insurance and a credit to Cash.

- Schedule Adjusting Entries: Set a recurring monthly reminder in your calendar or accounting software to expense the used portion. This keeps your books clean and accurate.

For a deeper dive, check out official accounting standards guides or use accounting software with templates for recurring entries. Looking at financial statement examples from public companies can also offer a masterclass in how the pros handle it.